Payroll Journal Entry for QuickBooks Online ASAP Help Center

Content

We also calculated the amount of taxes that the employer would need to pay. Imaging of back-up support in Perceptive Content or attaching documentation to the journal entry in EFS is required.

- Employers are required to submit multiple payroll forms to the…

- Imaging of back-up support in Perceptive Content or attaching documentation to the journal entry in the Enterprise Financial System is required.

- On December 31, the company must record the cost of work done during the week of December 25–31.

- Making proper payroll journal entries is a task with which all small business owners should be familiar.

- You would then use the 2400 Payroll Liabilities GL account when remitting the employer expenses, withholding, and deductions to the tax agency, benefits administrator, etc.

We also assist with travel and entertainment expenditures. To accrue vacation on the books, you must use a journal entry. Below is an example of the journal entry we would record for an employee who earns a wage of $30 per hour. For example, workers’ compensation is recognized as an expense once the time period that the premium covers has elapsed. At that time, if the payment has not been made, the amount becomes a debt and should be recorded as a liability until it’s paid to the insurance provider. As a small business owner, payroll accounting can be a headache. On payday, January 5, the checks will be distributed to the hourly-paid employees.

Step 1: Create manual tracking accounts

Below is a list of the accounts you will generally need to set up on your chart of accounts to track all payroll-related activities, along with a brief description of each account. There are some accounts you may not need, like health insurance if it’s not offered and others that are required, like federal income tax payable, to comply with payroll laws. The employer’s obligations are considered expenses on the income statement. Before examining the expense portion of the income statement, remember only taxes and deductions that the employer owes are included on the income statement as expenses. The payroll expenses are shown on the income statement with actual numbers. The other expense accounts have xxxxxxx instead of numbers.

Debit the wages, salaries, and company payroll taxes you paid. As you do your payroll accounting, record debits and credits in the ledger. Whether you debit or credit a payroll entry depends on the type of transaction made.

What Is a Payroll Journal Entry?

The payroll executives update this specific line item to record the cleared dues of the employees. The accrued wages are wages that the business owes to the employees corresponding to the service disbursed and are yet to be paid. If you are on a cash basis, you also have the option to enter payroll into your system without creating a journal entry. A bank payment showing the amount actually paid to your employees, so your bank balance is up to date and you can reconcile this with your bank statement. Add cash to your payroll account to ensure you cover all the necessary payroll costs. Wages and direct labor are the same thing in many cases, but they may differ in some industries.

Ex-bookkeeper admits stealing $2M from New Mexico auto body company – Repairer Driven News

Ex-bookkeeper admits stealing $2M from New Mexico auto body company.

Posted: Tue, 13 Sep 2022 07:00:00 GMT [source]

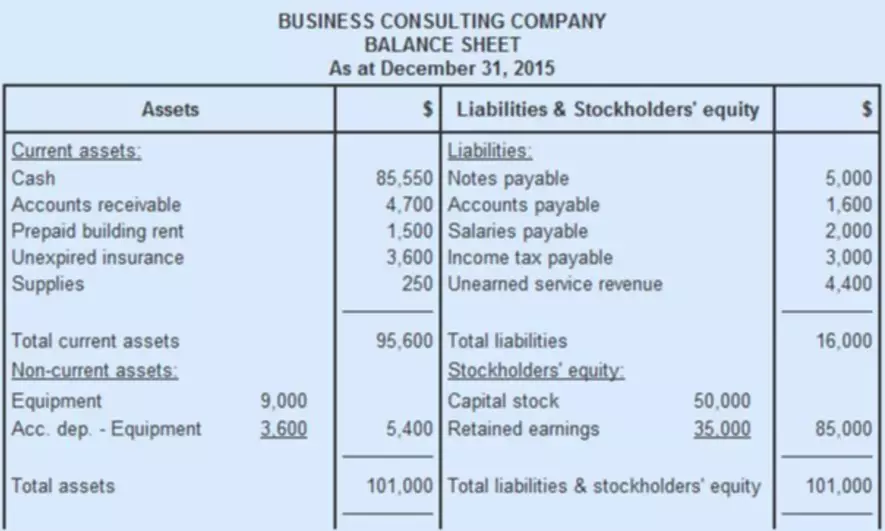

Use the info from your payroll report to create the journal entry. If you paid multiple employees for the pay period, you can combine all of their paycheck totals into one journal entry. You can also create separate journal entries for each employee if you need to break out the details. payroll accounting The taxes payable, wages payable, and other deductions appear on the balance sheet as current liabilities. Current liabilities that relate to payroll are shown with actual numbers on the balance sheet. The other current liability accounts have xxxxxxx instead of numbers.

Record your employer payroll deductions.

If you’re an employer, you can’t just be on your merry way after paying your employees. You also need to account for payroll expenses in your books. To ensure your accounting books are accurate, learn how to record payroll transactions. By doing this, we can use Restuarant365 for Bank Reconciliation for the payroll account and also capture the actual payroll expenses. According to Connecteam, a New York-based software firm that helps you manage your business, 2 in every 5 small companies face an average of $845 in annual IRS payroll tax penalties.

- The next step is to move cash from the operating account to the payroll account in anticipation of all cash payments going out.

- You don’t make a journal entry for each employee individually.

- The matching principle requires the company to report all of its December expenses on its December financial statements.

- In the meantime, keep reading for an easy way to record the information you need and some of the information you might want.

Let’s continue with our example of the payroll for the hourly-paid employees. We’ll assume that the distributor’s accounting month and accounting year both end on Saturday, December 31.

Examples of Payroll Journal Entries For Wages

Journal entries are used in accrual accounting to record payroll expenses that have been incurred, at the time the expense becomes payable. Unlike cash accounting, which records payments when they are actually made, accrual accounting expenses costs as they are obligated. Under an accrual accounting system, there are several journal entries related to payroll.

It has 3 major types, i.e., Transaction Entry, Adjusting Entry, & Closing Entry. These comprise accrued wages, manual payments, and initial recordings. These deductions are always in line with the applicable legal laws. For example, the deductions under the US laws are federal withholdings, FICA, state withholdings, employee health insurance costs, 401K, and disability taxes of state.

Types of payroll journal entries

Record accrued wages at the end of each accounting period. These entries show the amount of wages you owe to employees that have not yet been paid. After you pay the wages, reverse the entries in your ledger to https://www.bookstime.com/ account for the payment. Payroll accounting is an essential function for growth as well as large businesses. They help and manage the salaries, wages, bonuses, and commissions payable to the business employees.

This is where you calculate the payroll expenses you may owe. We break down what payroll entries are and how to make one to process your payroll.